The right MDF program can make all the difference, so long as it's used correctly.

Picture this: You allocate marketing development funds to a partner to run a booth at a trade show. The event goes well; your partner markets your product on your behalf and generates several high-quality leads, you gain brand recognition, meet your marketing goals, prove the value of your indirect sales channel, and your partner leaves feeling more secure in your partnership. But before you’re able to pop the champagne in celebration, you get an email from your legal team. It turns out the fund management was sloppy; the funds you used weren’t properly labeled and now you could be in some legal hot water.

No one wants to find themselves in such a predicament, and promotional allowance program restrictions can make launching an MDF and/or Co-Op program feel extra risky. But while a laissez-faire attitude towards the laws regulating them can quickly turn into a legal predicament, avoiding the endeavor altogether creates a business risk of its own. MDF and Co-Op programs help companies promote their products or services and increase sales by sharing channel marketing costs with their resellers or channel partners. In a market where consumers increasingly rely on recommendations, companies can use partner engagement to expand their reach, increase brand awareness and brand visibility, and create high value partner programs with strong lead generation. Therefore, opting out of such programs can result in your company losing out on an otherwise helpful edge over competitors.

There’s a middle ground between putting yourself at legal risk and refraining from promotional allowance programs altogether, and we’re here to help you find it. In this post we will cover:

- What are MDF and Co-Op programs?

- The Robbinson-Patman Act

- The Sarbanes-Oxley Act (SOX)

- Best practices for staying compliant

What Are MDF Programs?

A marketing development fund (MDF) lets channel marketers allocate MDF dollars to their partner base for sales and marketing strategies. In MDF incentive programs, these funds go towards the resources partners need to build brand visibility, generate sales leads, and drive business growth. This can include:

- Digital channel marketing campaigns (via email or social media)

- Industry trade shows

- Product launches

- Training programs

- Direct mail efforts

Unlike other types of funding, such as co-op funds (more on those later), MDF funds are typically allocated on a discretionary (non-contractual) basis used to seed new market opportunities, available prior to the revenue being generated, allowing the partner base to use the funding on a case-by-case basis to fulfill tactical lead generation, enablement or product/market awareness needs, or from the vendor’s perspective, to drive immediate desired channel partner behavior. This helps companies build strong, long-lasting partnerships and attract new partners while also empowering their partners with the resources they need in a timely manner.

Consider an MDF program if you’re looking for:

- Efficiency. MDF programs provide partners with greater flexibility to design marketing campaigns that are tailored to their specific market and audience, allowing them to respond more quickly to changes in customer needs and market trends.

- Effectiveness. Since these funds’ uses are much broader and tend to be executed by partners, vendors should develop a prescriptive marketing approach to MDF and deliver menu-based plays for partners to adopt.

- Increased channel partner ownership. MDF programs give partners a greater sense of ownership over their marketing activities, as they can use the funds to design campaigns that align with their individual business goals and objectives.

What Are Co-Op Programs?

Co-Op programs refer to contractual, accrual-based marketing funds where companies and partners split the cost of marketing activities such as advertising, promotion, and other sales-driving initiatives. Co-Op funding is allocated for specific activities that must meet certain guidelines and requirements and accrues as a percentage of revenue is achieved. Vendors allocate co-op funds systematically for the execution of specific marketing initiatives, often pre-planned with the channel partner during the quarterly planning process. These types of incentive programs have defined revenue percentages – between 1 and 5 percent depending on the channel strategy – and should be included in a contract within the channel partner program agreement.

Consider a Co-Op program if you’re looking for:

- Consistent brand representation. Co-Op programs allow companies to ensure that their brand is being represented in a consistent manner across all partner activities, which can be important in maintaining a strong brand image.

- Greater control. Co-Op programs provide companies with greater control over partner activities, as they require closer monitoring and reporting on partner activity. This can be beneficial for companies that want to ensure that their marketing funds are being used effectively.

- More trackable ROI. Co-Op programs can provide a better return on investment (ROI) for companies by sharing advertising and promotion costs with their partners. This can help to reduce the overall cost of marketing programs and maximize the impact of available resources. According to Canalys Research, 64% of vendors are offering proposal-based MDF, funding things like non-transacting partners, the growth of marketplaces, subscription and consumption models, and ecosystems. Yet 28% of vendors are offering a hybrid of co-op (accrual-based) and market development funds (proposal-based) to their partners. These incentive programs offer a mixture of earned and discretionary funds depending on your partner program goals. And only 9% offer Co-Op only.

To design a successful market development funds (MDF) or Co-Op program that meets the requirements of your corporate legal team and finance department, it's crucial to have a thorough understanding of promotional allowance program regulations. Below, we are covering the two most important laws that impact these regulations.

The Robinson-Patman Act

The Robinson-Patman Act is a federal law enacted in 1936 to prevent anti-trust practices and ensure fair trade between competing retailers. The law limits price discrepancies granted to retailers by their suppliers, providing more protection to small independent retailers from their larger counterparts. Subsequent amendments specifically legislate promotional allowances, which were originally conceived as a work-around. While interpreting how the act applies to the allocation of these allowances to your channel partners is ultimately up to your own legal team, the regulation requires that a seller offer all competing resellers similar programs in a proportionate and equal manner.

Recently, the Federal Trade Commission (FTC) has been taking a stricter stance on enforcing the Robinson-Patman Act by closely scrutinizing pricing practices to ensure that they are being offered in a non-discriminatory and proportionately equal manner. Since companies that violate the act can face legal and financial penalties, there’s growing concern among businesses about ensuring compliance.

But while holding off on MDF and Co-Op programs might seem like the legally responsible option, companies that refrain lose out on a powerful tool for attracting new partners and therefore tapping into larger end-customer audiences. Like many other legally monitored business practices, understanding the law and proceeding accordingly should ensure compliancy without falling behind competitors.

The impact on marketing funds

The Robinson-Patman Act has a significant impact on marketing discretionary fund (MDF) programs:

- MDF funds must be allocated in a non-discriminatory manner, meaning that they cannot be offered to certain partners at the expense of others. This ensures that all partners have an equal opportunity to benefit from the program.

- MDF programs cannot be used to influence a partner's purchasing decisions. Companies cannot use MDF funds to offer better pricing or discounts to partners who agree to purchase more products from them, as this would be considered discriminatory under the Robinson-Patman Act.

- MDF programs must be structured in a way that is transparent and fair to all partners. The criteria for qualifying for MDF funds should be defined and communicated consistently to all partners.

- MDF programs should be evaluated regularly to ensure that they are not being used in a discriminatory manner. Companies should monitor the distribution of MDF funds to ensure that they are being allocated fairly and proportionately to all partners.

Like with MDF programs, the Robinson-Patman Act requires Co-Op programs to be offered in a non-discriminatory manner to all qualifying resellers:

- The act requires that Co-Op programs be structured proportionately equal, meaning that companies must offer similar benefits and opportunities to all qualifying resellers based on measurable criteria such as sales volume, geographic location, and number of certified personnel.

- Companies must ensure that Co-Op programs don't influence purchasing decisions or give an unfair competitive advantage to certain resellers over others. They must also avoid any practices that could be perceived as discriminatory or anti-competitive.

- To comply with the act, companies should establish clear guidelines and criteria for Co-Op programs and monitor their implementation to ensure they are being offered fairly and proportionately. Companies should also provide training and support to their resellers to help them understand the requirements and benefits of the program.

The Sarbanes-Oxley Act (SOX)

The accounting scandals at Enron and WorldCom involved the intentional misreporting of earnings to shareholders and fraudulent activities to conceal the true financial conditions of companies involved. The result? The creation of regulatory requirements known as the Sarbanes-Oxley Act (SOX). Prior to SOX, many companies reported trade allowances as marketing expenses, but under the guidelines established by SOX, these expenses were viewed as perks or sales rewards to be classified as contra-revenue. As a result, the classification of expenses charged to promotional allowance programs changed significantly.

Under the SOX Act, companies must classify expenses correctly as either operational expenses or contra funds, and they must ensure that their accounting practices comply with SOX regulations. Failure to do so can result in legal and financial penalties.

Contra-revenue refers to:

- Funds that offset revenue, such as returns, allowances, or discounts.

- Subtracted from gross revenue to arrive at net revenue.

- Not considered operating expenses because they don't represent a direct cost associated with producing or delivering goods or services. Rather, they are adjustments made to revenue.

Comparatively, operational expenses (OpEx) require that:

- The payment covers a service by the partner that offers a clear benefit to you.

- Related to the production and delivery of goods or services and are included in the calculation of net income.

- The benefit is clearly separable from the sale of the product.

- The benefit could be purchased by you from a source other than the partner.

- You have obtained proof of performance to reasonably estimate true cost.

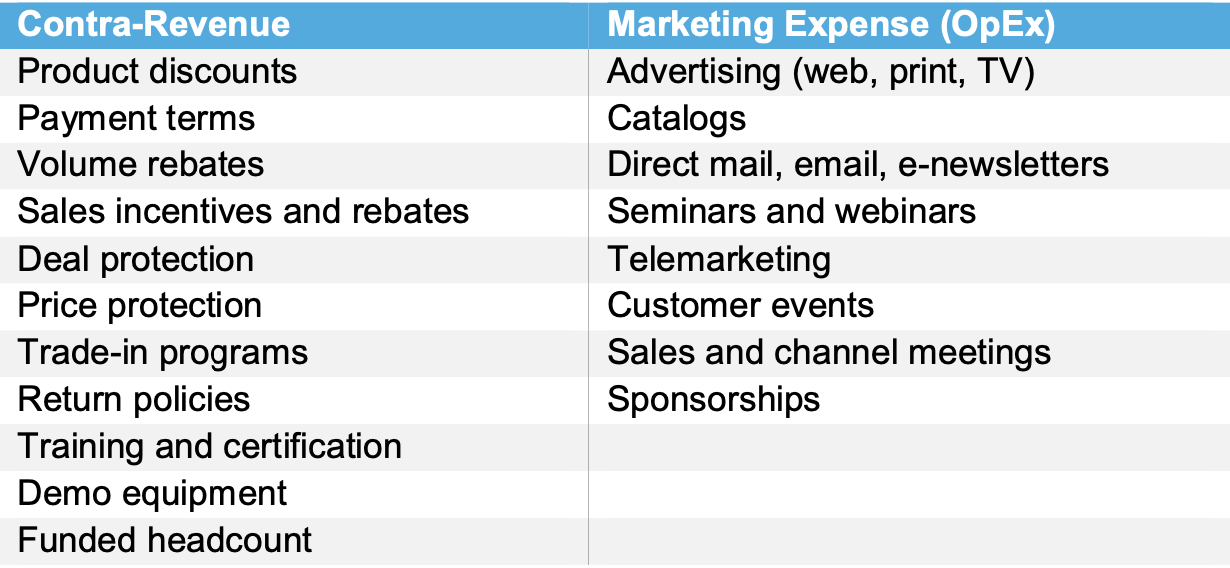

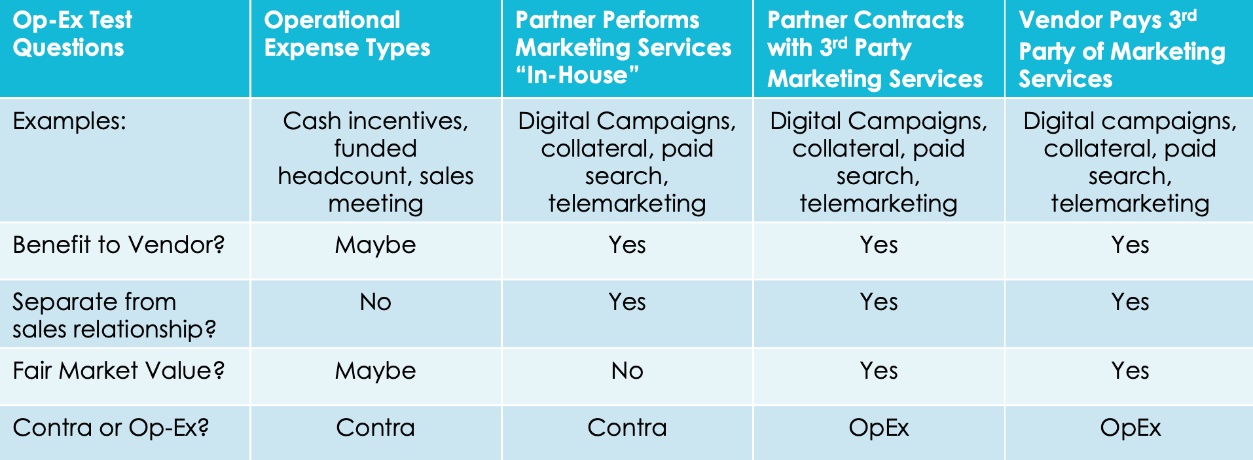

Some examples of contra-revenue versus OpEx

Staying Compliant

Tip #1: Outsource to a third-party

Using third-party software to manage Market Development Funds (MDF) and Co-Op programs can be an effective way to ensure compliance with program allowance regulations. Platforms like 360insights provide an unparalleled combination of audit, analytics, and expertise to protect businesses against fraud and ensure that claims are processed correctly. With 360insights, every claim is audited, every payment is reconciled, and every transaction is analyzed, all without compromising the user experience. By partnering with 360insights, companies can have peace of mind knowing that their MDF and Co-Op programs are being managed in a compliant and effective manner.

Tip #2: Consider important keywords in your program language

(For compliancy with Robinson-Patman Act) The law states that “all competing partners [with equal access to the customer] must be offered similar programs on a proportionately equal basis.” Therefore, it is important to consider the language that you use to communicate to partners. Although it is not uncommon for manufacturers to offer different programs of varying value to channel partners, manufacturers should use the following keywords:

- “Competing resellers” implies that potential customers have equal access to different resellers or segments. However, a government reseller may not sell to corporate customers; therefore, the government reseller could qualify for a different program.

- “Proportionately equal” doesn’t mean equal programs, rather that programs can vary by sales, number of locations, number of certified personnel, or any other measurable criterion that scales.

- “Offer” does not mean promoted because you can selectively recruit resellers you want to participate versus merely informing others.

- “Similar” doesn’t mean identical program. “Similar” means the program has the same value.

Tip #3: Use test questions to accurately categorize OpEx and contra-revenue

(For compliancy with SOX Act)

The classification of marketing expenses usually depends on the specific accounting framework or guidelines followed by a company. These criteria help evaluate whether an expense meets the requirements for recognition as a marketing expense. While I can provide you with a general framework, please note that specific rules and guidelines may vary depending on the accounting standards adopted by the vendor or jurisdiction. Here are four common tests used to evaluate marketing expenses:

Intent

Was the expenditure incurred with the intention of promoting or selling products or services? The primary purpose of the expense should be to generate revenue or enhance the company's marketing efforts.

Benefit

Did the expense provide a direct or indirect benefit to the company's marketing goals or activities? The expenditure should contribute to or support marketing initiatives, such as advertising, promotions, market research, or brand building.

Reasonableness

Is the amount spent on the expense reasonable and justifiable based on the company's marketing objectives and industry standards? The expense should be proportionate to the expected benefits and consistent with industry practices.

Direct Attribution

Can the expense be directly linked to specific marketing activities or campaigns? The expenditure should have a clear connection to marketing efforts and should be able to be allocated or assigned to specific marketing initiatives.

It's important to note that these tests are not exhaustive and may vary depending on the specific circumstances and accounting standards applied. Consulting with an accountant or referring to the applicable accounting guidelines for your jurisdiction would provide the most accurate and up-to-date information regarding the classification of marketing expenses.

Tip #4: Run your program by your legal and finance departments before launching

Even after implementing best practices for Market Development Funds (MDF) and Co-Op programs, it's crucial to run your programs by your legal and financial departments to avoid any potential penalties for non-compliance with program allowance regulations. While tips #1-3 can help you heavily minimize the work that these departments need to do, it's still important to have them review the program before implementation. By involving legal and financial departments early on, you can get buy-in and support for your MDF and Co-Op programs while identifying potential legal and financial issues and save time and resources down the line. By working together with these departments, businesses can be confident that they are meeting requirements and avoiding potential legal or financial penalties.