The State of the Auto Aftermarket Industry: Reflections on the 2024 Vision Conference

Market Funds: Lighten Your Administrative Load

Market Development Funds 101: MDF and Co-Op Explained

7 Reasons To Use a Sales Incentive Travel Program

7 Powerful Incentive Travel Trends You Need to Know

The Women Of 360insights: International Women's Day 2024

360insights Completes Acquisition of HMI Performance Incentives™

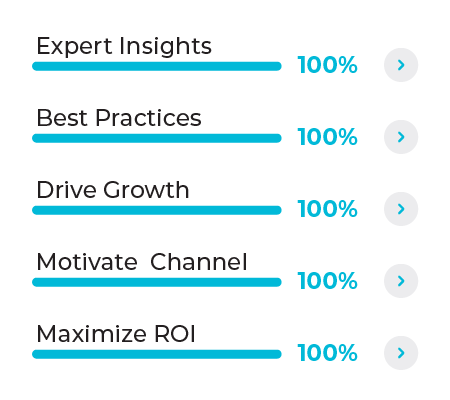

From Frustration to Influence: How Manufacturers Can Impact End Sales

Cash or Points? Choosing the Best Reward Program for Your Business